Insurance Solutions in The Maritimes

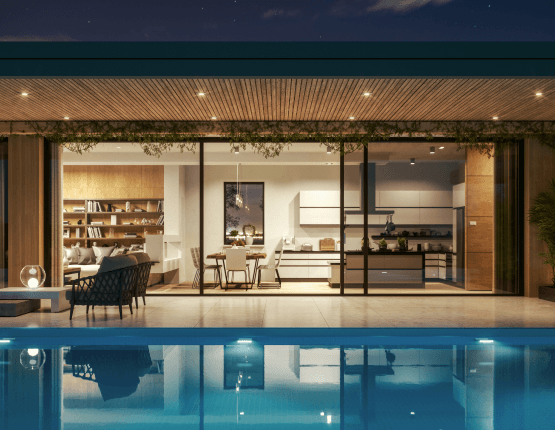

We understand that a high-value home is more than just a place to live. A high-value home is a sanctuary that reflects your lifestyle, achievements, and personal taste. With unique features such as custom architecture, high-end interior designs, sophisticated security systems, and valuable content including art, antiques, and jewelry, luxury properties require specialized insurance solutions.

Trust Caldwell to Handle your High-Value Property

With expertise in high-value properties and a commitment to exceptional service, Caldwell is your trusted partner in protecting your luxury home. Contact one of our brokers today to learn more about our specialized insurance solutions and how we can help secure your high-value sanctuary.

At an average premium of $ 1336.46 per year, high-value property insurance is a necessity. Contact one of our brokers to get a quote today.

Catering to Your Lifestyle

High-value home insurance extends beyond the physical structure, acknowledging your lifestyle and privacy needs. From in-home galleries to private docks, every detail is meticulously considered. We ensure that leisure and luxury, from your vintage wine collection to your custom-built yacht, are comprehensively protected under our specialized policies, providing unparalleled peace of mind.

Unique Risks for High-Value Properties

High-value homes in the Maritime provinces face unique risks that standard policies may not fully cover. These can include:

- Climate and Environmental Risks: The diverse climate poses various risks to luxury homes.

- Security Concerns: High-value properties are often targets for theft, requiring advanced security measures and comprehensive coverage for theft, vandalism, and privacy breaches.

- Custom Features and Values: Custom-built features and expensive belongings demand specialized coverage to ensure their full value is protected against damage or loss.

Proactive Protection for the Discerning Homeowner

Our high-value home insurance policies encompass proactive monitoring and rapid response services, ensuring that potential threats to your property, from natural disasters to technological breaches, are swiftly addressed. This forward-thinking approach minimizes risks, ensuring that your serene living environment remains uninterrupted, and your investment is preserved for generations to come. Our high-value home insurance solutions are tailored to meet the unique needs of luxury property owners. See our insurance coverage options below.

Why Choose Caldwell Roach Insurance?

High-Value Home Coverage Options

High-Value Home FAQs

High-value home insurance is specifically tailored for properties that exceed typical market values, offering broader coverage limits and additional protections. High-value home insurance covers unique features such as custom construction, high-end technology, and valuable content like art and antiques, providing a more comprehensive approach compared to standard home insurance.

Absolutely. High-value home insurance policies are designed to accommodate unique property features, including indoor pools, custom art studios, home theaters, and more. We work with you to understand your home’s specific needs and ensure these distinctive elements are fully protected under your policy.

Your personal belongings, particularly high-value items, are appraised to determine their worth, ensuring adequate coverage. High-value home insurance typically includes comprehensive content coverage that protects valuable possessions at their appraised value, whether they’re located inside or outside your home.

In addition to standard coverage, high-value home insurance often includes benefits like identity theft protection, kidnapping and ransom coverage, and access to high-quality emergency repair services. Policies may also offer higher limits for liability coverage and in-home business activities.

Premiums can be reduced by implementing security and safety measures, such as advanced alarm systems, fire suppression systems, and gated community living. Additionally, choosing a higher deductible can lower your premiums. Our brokers can assess your property and recommend specific measures to help reduce your insurance costs while maintaining comprehensive coverage.