What is Marine Insurance?

Marine insurance provides essential coverage for the risks associated with the transportation of goods and materials over water. It’s designed to protect against the loss or damage of ships, cargo, terminals, and any other property involved in the shipping process. Given the significant economic activities centered around shipping, fishing, and other marine ventures in this region, marine insurance provides a safety net, ensuring that businesses can operate with confidence, knowing that their assets and operations are protected against a myriad of risks at sea.

How Does Marine Insurance Protect my Business?

The scope of marine insurance is vast, offering protection against risks, including natural disasters, piracy, and logistical challenges. Insurance policies can be tailored to the specific needs of ship owners, cargo owners, or any parties involved in the maritime trade. From small fishing vessels to larger commercial vessels, and from bulk cargo to precious goods, marine insurance provides security that ensures the smooth operation of maritime commerce. Whether dealing with domestic trade within Canada or engaging in international shipping, marine insurance safeguards your assets against the unexpected incidents that can occur in open waters.

How are Marine Insurance Rates Calculated?

The cost of marine insurance premiums is influenced by a variety of factors. These factors include the value of the goods being shipped, the chosen route, the mode of transport, the nature of the cargo, and the condition of the vessel. Additionally, risk evaluations consider historical loss data for specific regions or routes, as well as the claims history of the shipowner or cargo owner.

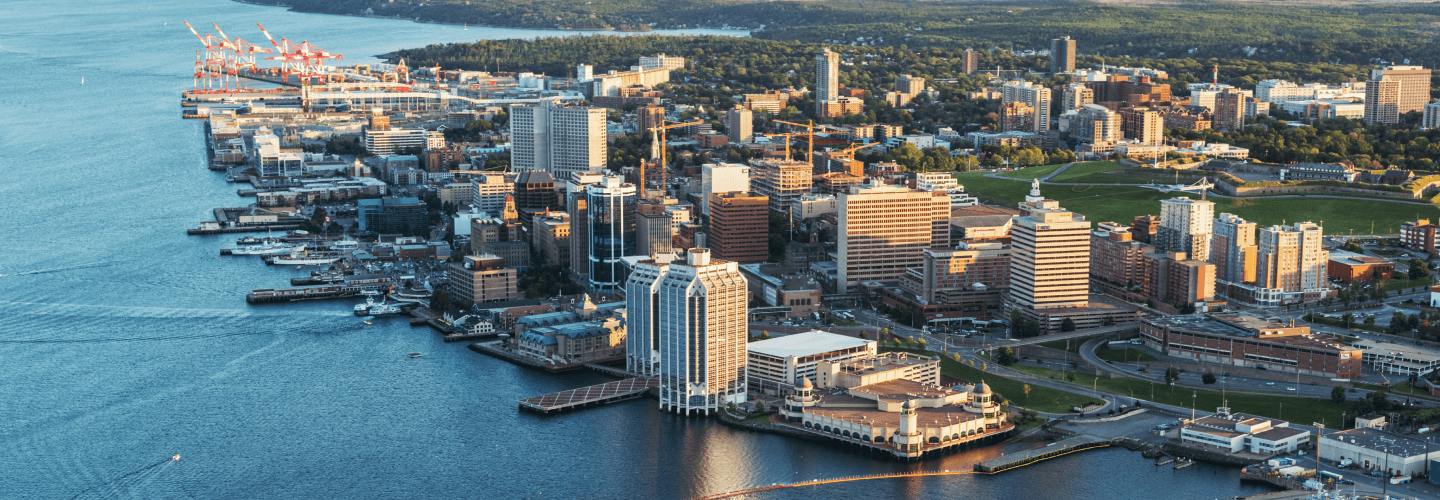

Why Marine Insurance is Essential in The Maritime Provinces

Why Choose Caldwell Roach Insurance?

Tailor your Commercial Marine Insurance Policy

Marine insurance plans can be customized to cater to the unique requirements of your organization. This personalization may involve modifying coverage limits, selecting which risks are covered or excluded, and incorporating special provisions for cargo, journeys, or types of vessels. Insurers collaborate with clients to evaluate their distinct risk profiles and needs, proposing insurance solutions that not only offer sufficient protection but are also cost-efficient. Businesses and individuals are encouraged to have detailed conversations with our skilled insurance brokers to guarantee that their marine insurance policy adequately secures their maritime activities.

What is Covered under a Marine Insurance Policy?

Additional Marine Coverage Options

Marine Insurance FAQs

Marine insurance is essential for ship owners, cargo owners, charterers, freight forwarders, and logistics operators. It’s vital for businesses involved in transporting goods over water, either domestically or internationally, as it provides financial protection against potential losses during transit.

Marine insurance policies can vary widely but typically cover loss or damage to the vessel and its cargo. This can include coverage for natural disasters, collisions, piracy, theft, and other unforeseen incidents. Policies may also cover liability for damage caused to other vessels, cargo, or environmental damage.

Premiums for marine insurance are determined based on various factors, including the value of the goods being transported, the route taken, the mode of transportation, the type of cargo, and the vessel’s condition. Risk assessments may also consider historical data on losses in certain areas or routes and the shipowner’s or cargo owner’s claims history.

In the event of a loss or damage, the insured should immediately notify their insurer of all the details of the incident. It’s important to document the damage with photographs and gather any relevant reports (e.g., a police report in the case of theft). The insurer or a broker will then guide the insured through the claims process, which may involve an assessment by a surveyor to determine the extent of the damages and the claim’s validity.

Yes, marine insurance policies can often be tailored to meet the specific needs of the insured. This customization can include adjusting coverage limits, including or excluding certain types of risks, and adding additional clauses for specific scenarios related to the cargo, voyage, or vessel type. Insurance providers work with clients to assess their unique risks and requirements, offering solutions that provide adequate protection while also considering cost-effectiveness. It’s important for businesses and individuals to discuss their specific needs with their insurance agent or broker to ensure their policy provides the coverage necessary for their maritime operations.